Transforming Your Money Journey with Spendify

Overview

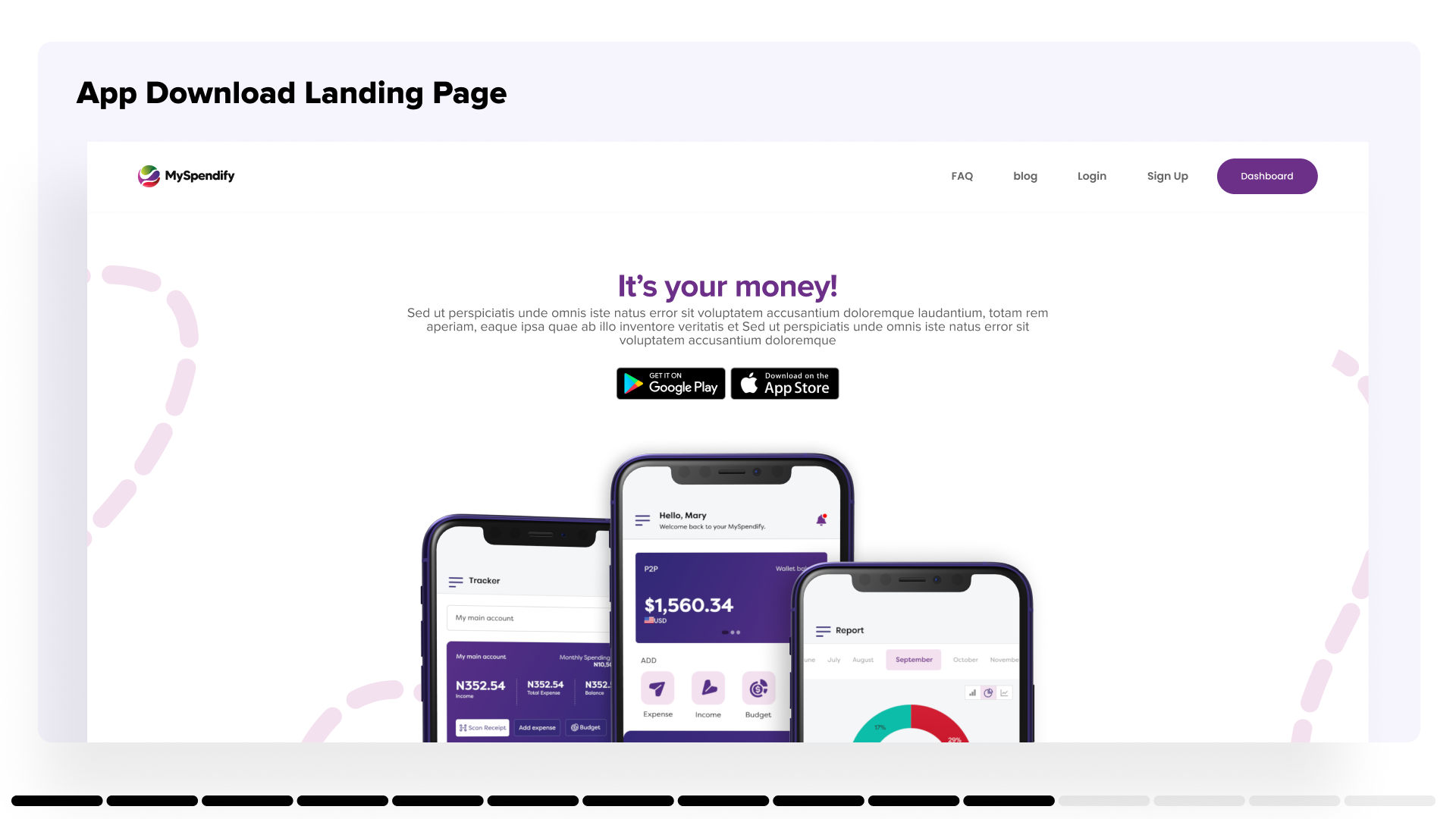

My-Spendify is an early-stage startup looking to build its MVP. The product is a personal finance management application designed to assist users in taking control of their finances and making informed decisions.

I led the user experience and all design efforts. My responsibilities included conducting user research, creating wireframes, and creating interactive prototypes. I played a pivotal role in shaping the app’s information architecture and visual design, ensuring a seamless and user-friendly experience. Additionally, I collaborated closely with the development team to bring the design vision to life.

Research & Analysis

Better Financial Insight:

Many expressed a desire for deeper insights into their spending patterns and saving potential. This indicates a demand for features that provide actionable recommendations and highlight areas for potential cost savings.

Accessibility:

It was noted that the app should be designed with accessibility features to accommodate users with diverse needs. This could include considerations for visually impaired users, ensuring the app is usable by a wider audience.

Tech-Savviness Levels Vary

Some participants exhibited higher tech-savviness, while others had more limited digital literacy. This underscores the importance of a user interface that is intuitive and user-friendly, catering to a broad range of digital proficiency levels.

Need for Clear Visualizations

Many participants emphasized the importance of clear, easy-to-understand visualizations for expense tracking and budgeting. This highlights the significance of visual design elements in facilitating effective financial management.

Security & Privacy

Several participants expressed concerns about the security of their financial information. This underscores the need for robust security measures and clear communication about data protection within the app.

Financial Education:

Some users expressed interest in educational resources on personal finance topics. This suggests an opportunity to incorporate educational content or resources within the app to empoIr users with financial knowledge.

The Challenge

The primary challenge I addressed was the widespread difficulty users faced in managing personal finances effectively. Many individuals found it challenging to track expenses, set realistic budgets, and make informed financial decisions. This issue was exacerbated by the absence of user-friendly tools tailored to their specific needs.

Origin of the Problem

The problem stemmed from a combination of factors, including complex, unintuitive finance management tools on the market and a lack of personalized guidance for users. Existing apps often overwhelm users with features, making it hard for them to gain a clear understanding of their financial health.

User/Customer Profile:

Our target users are diverse, ranging from young professionals to families and retirees. They all shared a common experience of feeling overwhelmed by the complexities of personal finance management. They sought a solution that would encourage them to take control of their financial situation.

Significance of the Problem:

Effective financial management is crucial for individuals to achieve their life goals and secure their financial future. Without a user-friendly tool, users are at risk of making uninformed financial decisions that could impact their long-term financial health. Addressing this challenge was essential to promoting financial empowerment and improving overall well-being.

Target Audience

Millennials, Gen-z, they are the demography which use more internet and mobile banking in Nigeria. Another category of users are people slightly above the millennials (Get-X) that are tech inclined, they adopters of digital finance solutions. They are user previously used to the manual ways of doing things so they are open to a better solution.

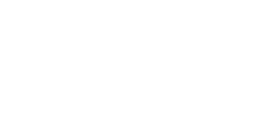

User Persona

Working with user personas has helped me in several ways, including being able to easily empathize with users’ problems and frustrations and being able to design solutions that address their specific pain points.

Business Goals

Efficient Expense Tracking:

Users should be able to effortlessly log and categorize their expenses, providing them with a clear and accurate overview of their spending habits.

Actionable Financial Insights:

Users should receive tailored recommendations and insights based on their spending patterns, helping them make informed decisions to improve their financial health.

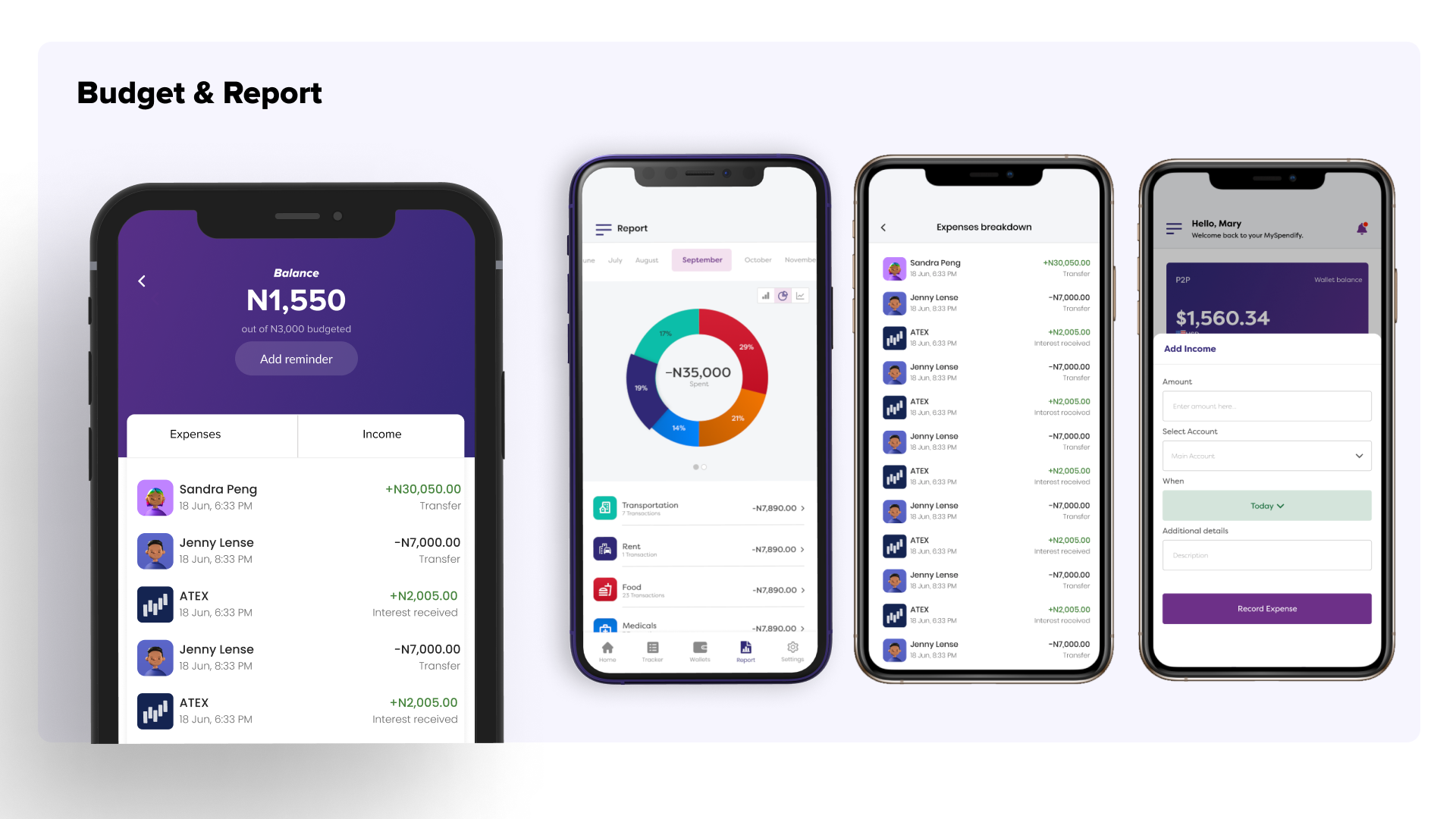

Budgeting

The app should enable users to set, manage, and track personalized budgets aligned with their financial goals. This encourages them to proactively manage their finances.

User-friendly Interface

The design should offer an intuitive and visually appealing interface that ensures a seamless and enjoyable user experience.

High Engagement and Adoption

Success will be indicated by a significant increase in daily active users and a positive trend in user retention rates.

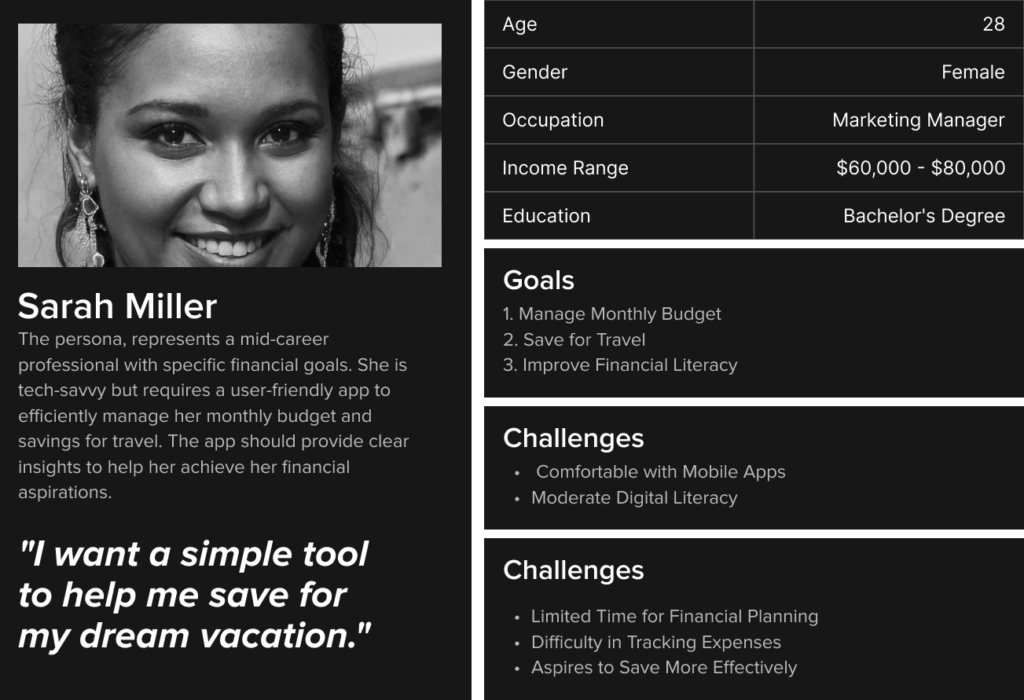

Design Methodology

My design methodology approach for this project was rooted in the Design Thinking process, which emphasizes empathy, ideation, and iteration.

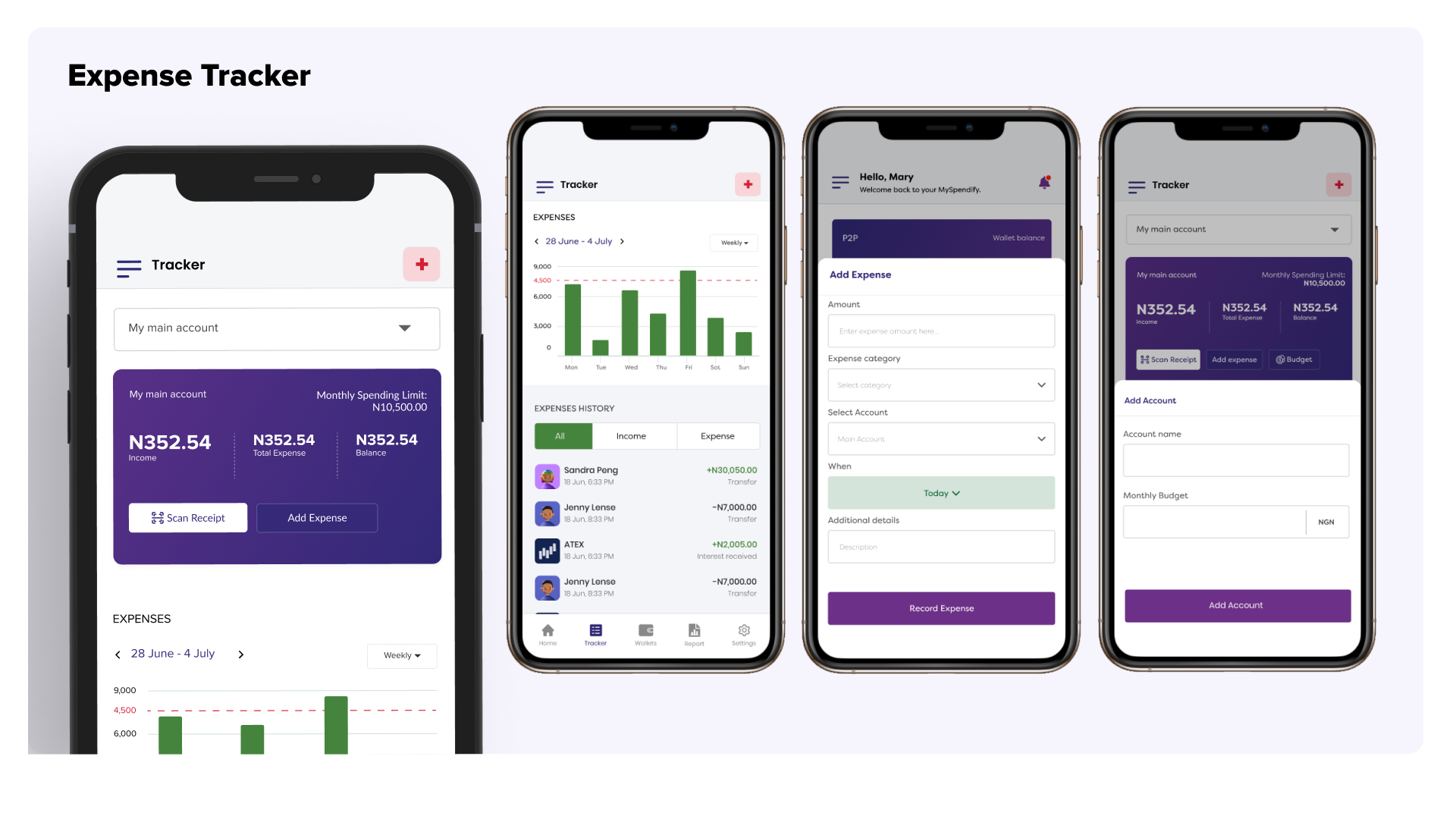

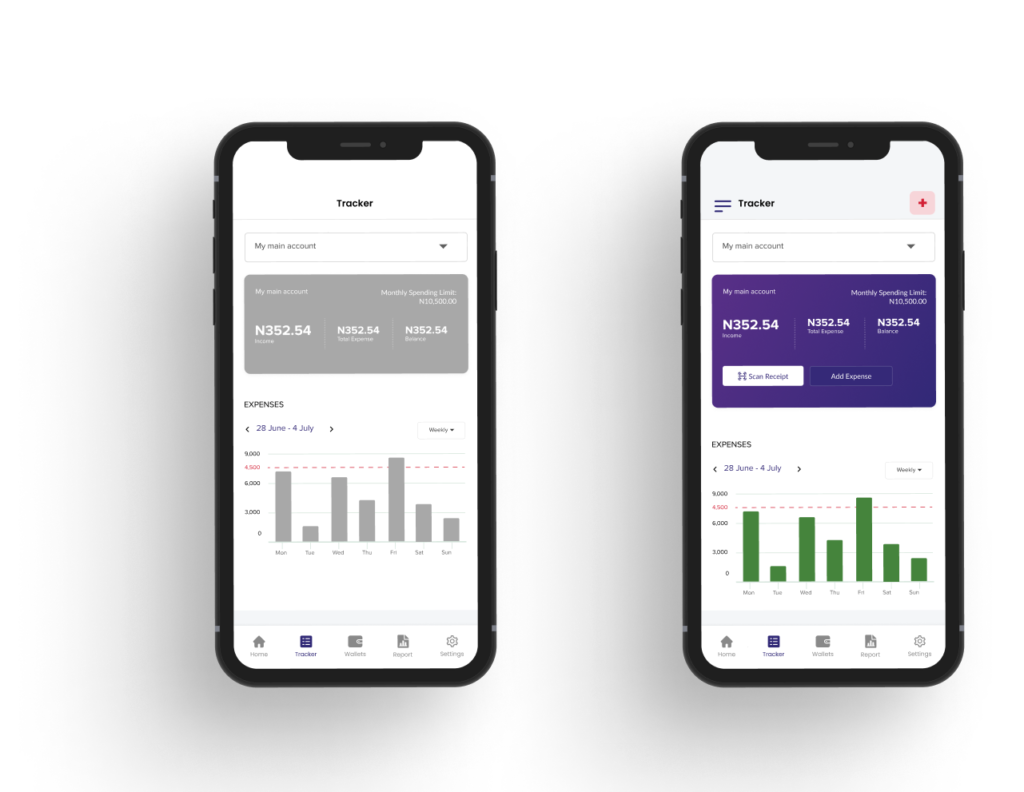

Wireframes

During the wire-framing and prototyping phase, I created the initial layout and functionality of the app to better understand how the user would interact with it. Sketching allowed me to create a visual representation of the user’s journey and possible interactions, ensuring that the app would be easy to navigate. I then built interactive prototypes that allowed us to test and refine the app’s key features. This stage was crucial in developing the app’s interface and flow, making sure that the final product would meet the needs and expectations of our users. Overall, this process helped me to better understand the design of the app and how it would work in practice, setting the foundation for a seamless and intuitive user experience.

Usability Testing and Iteration

I conducted usability tests with real users to gather feedback on the initial design. Their insights guided iterative improvements, resulting in a more user-friendly app.

Conclusion

In conclusion, the design process for the ‘My Spendify App’ was driven by a user-centered approach, emphasizing empathy, iterative testing, and thoughtful trade-offs. By conducting extensive research, prioritizing key features, and ensuring accessibility, the app emerged as an intuitive and inclusive personal finance management tool. The seamless integration of user feedback and careful consideration of constraints led to a refined product that is poised to make a positive impact on users’ financial well-being.